Some see Bitcoin as a once-in-a-generation investment opportunity, while others regard it as a technological revolution that promotes decentralised governance and increased freedom. However, for a pre-coiner (someone who hasn’t bought bitcoin yet), this doesn’t fully address the question, “Why Bitcoin?” In an ideal world, this could be summarised in one sentence. As Parker Lewis of Unchained Capital aptly notes:

“…practically everyone is unequipped to evaluate bitcoin because it does not fit any prior mental framework… To make it even more difficult, bitcoin is so abstract an application and so far from a tangible phenomenon, that it is like staring into the abyss. Bitcoin is both difficult to see and impossible to unsee once discovered”

Parker Lewis

To understand Bitcoin, you need to understand money. And to understand money, you need to grasp its history and how we arrived at our modern understanding.

What is Money?

Consider this question: What makes money valuable, and who gets to decide that? It’s a difficult question, one most of us haven’t considered. The history and evolution of money can shed light on this. It’s a complex story with many twists and turns, so we’ll focus on the main themes to keep things simple.

Thousands of years ago, our ancestors roamed the earth in small tribes, bartering goods and services. Over time, they realised bartering was inefficient because you didn’t always want or need what the other person had. Eventually, they introduced a medium of exchange that both parties valued. This varied across different societies and included seashells, flint, stones, cattle, salt, or anything rare and symbolically valuable.

Even within societies, not everyone agreed on the medium of exchange. People began speculating on which medium (or “money”) would become widely accepted. Early predictors could acquire it cheaply before its value increased with demand and adoption. This feedback loop led societies to adopt a singular store of value, aligning all participants’ interests.

As technology advanced and trade routes developed over centuries, societies had to decide whether to store wealth in their own or another party’s store of value. Eventually, the world converged on a bimetal standard: gold as the primary store of value and silver for everyday transactions.

Gold was chosen for its qualities as a good store of value—preserving purchasing power over time:

- Durable – not easily perishable or destroyed

- Portable – easy to transport and store

- Fungible – interchangeable with another of equal quantity

- Verifiable – quick and easy to identify, difficult to forge

- Divisible – easy to subdivide

- Scarce – probably the most important and defining attribute

Over time, gold’s downsides became apparent—it was expensive to store and difficult to transport in large quantities, especially across continents. This led to the creation of paper money backed by gold, allowing holders to claim gold. This was the “gold standard.” Paper money was “sound” because its supply couldn’t increase without a proportionate increase in gold. The gold standard facilitated trade and solved many logistical and security issues associated with using gold as money.

However, history shows that those controlling money supply often seek ways to increase it for personal interests. From Roman emperors devaluing gold coins with other metals to modern governments printing money to finance wars, the gold standard was often unpopular with leaders as it imposed fiscal discipline—they couldn’t increase money supply at will.

The story is complex, but in brief, following World War II, the US dollar became the global reserve currency, pegged to gold. As the US faced financial difficulties, its allies began redeeming their dollars for gold. In response, President Richard Nixon broke the gold standard in 1971. US dollars could no longer be redeemed for gold, ushering in the fiat currency era.

What Does Bitcoin Solve?

Historically, under the gold standard, the value of money was directly linked to a quantity of gold, limiting the ability to create more money unless it was backed by gold. Fiat currency, however, has no such limitations, as its value is based on trust and government decree. This makes it easy to increase the supply, leading to debasement over time.

Inflation acts as a tax without legislation.

“Inflation is the parent of unemployment and the unseen robber of those who have saved.”

Margaret Thatcher

As free individuals, we have limited time on earth to exchange our finite resources (time and energy) for monetary goods. We aim to store our time and energy in monetary goods that maintain purchasing power over time. Fiat currency is inherently inflationary, debasing your savings and undermining the time and energy you spent acquiring these goods. This fundamentally prevents you from storing and retaining wealth for the future.

This is the primary problem that Bitcoin aims to solve.

What is Bitcoin?

Bitcoin was created by Satoshi Nakamoto in 2009, following the 2008 Global Financial Crisis. Satoshi provided an alternative to the centralised, debt-based fiat monetary system and the risks of quantitative easing (commonly known as “money printing”) and currency debasement. Using a combination of cryptography, mathematics, and blockchain technology, he created Bitcoin, the world’s hardest, soundest, and fully decentralised monetary asset.

“Bitcoin” (with a capital “B”) refers to the decentralised peer-to-peer network or protocol, while “bitcoin” (with a small “b”) is the digital currency transferred on the network.

Bitcoin stands in contrast to the existing financial system where central banks control monetary policy, commercial banks custody assets, and payment processors facilitate transactions. Unlike fiat currency, Bitcoin has no central bank or single administrator. Bitcoins (or fractions thereof, known as “Satoshis”) can be sent peer-to-peer on the network without intermediaries.

Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger (the blockchain). The network remains secure through mining, a process where transactions are validated, and miners are rewarded with newly minted bitcoins at a predetermined rate.

Bitcoin’s Unique Attributes

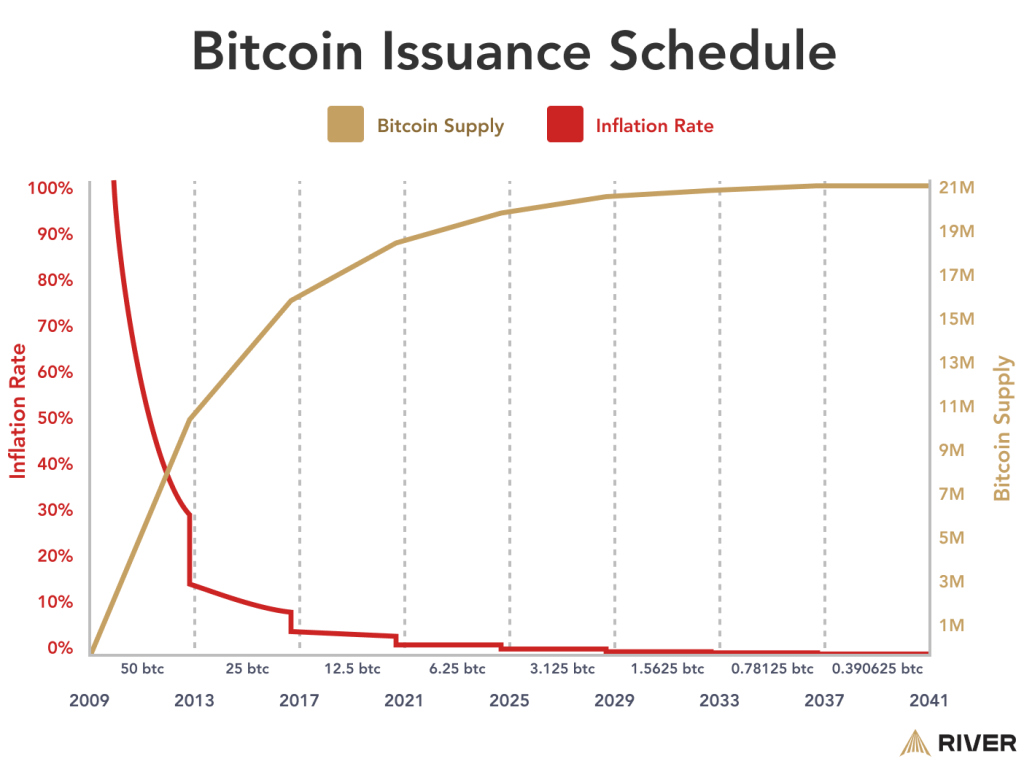

Unlike the current financial system, Bitcoin has no centralised authority to influence its supply. The software ensures that there will only ever be 21 million bitcoins. Each bitcoin consists of 100 million Satoshis (or “Sats”). Bitcoin’s inflation rate is currently just under 2%, but this will decrease over time until the last bitcoin is mined around 2140. Bitcoin’s supply curve (or monetary policy) is entirely predictable, embedded in the code.

With a fixed supply and predictable monetary policy, Bitcoin’s value cannot be inflated away through increased supply. This makes it arguably the best form of money created to date – an innately scarce, divisible, transferable, verifiable, and fungible form of money incapable of centralised debasement or confiscation.

Another key feature of the Bitcoin network is its decentralised nature, allowing for self-custody of digital assets (eliminating the need for banks) and the swift, securely encrypted transfer of value (bitcoins) directly, peer-to-peer, across jurisdictions, removing the need for third-party payment processors. Its decentralisation ensures that it cannot be inflated away or confiscated, as no single person, company, or government controls it.

Why Invest in Bitcoin?

Bitcoin’s Reliable Monetary Policy and Inherent Scarcity

With a fixed supply cap of 21 million, and 93% already mined, Bitcoin stands as one of the scarcest assets globally. Additionally, it’s estimated that around 4 million Bitcoins are lost or otherwise unrecoverable, further increasing its scarcity.

Moreover, Bitcoin’s supply is perfectly inelastic, meaning that increased demand does not affect the rate at which new bitcoins are created. Unlike central banks where a few individuals decide monetary policy, Bitcoin’s policy is entirely predictable and encoded into its system. Bitcoin’s current inflation rate is now 0.87%, below gold since the Bitcoin halving in May 2024.

Optimal Macro Environment

Following the Global Financial Crisis (GFC), we entered a world characterised by rising debt levels, low interest rates, and negative bond yields. In March 2020, the COVID-19 pandemic triggered a significant deleveraging event in capital markets, leading to the collapse of most asset classes.

In response, central banks globally began printing money at unprecedented rates to stimulate economies. This led to a surge in debt and budget deficits, with the money supply increasing by 15-40% in most developed countries since 2021.

These macroeconomic conditions, which have resulted in record levels of inflation, create an ideal environment for inflation-hedge assets. Historically, investors have turned to gold to preserve their purchasing power. Today, Bitcoin serves that purpose.

Bitcoin Has Become Mainstream

Over 12 years, Bitcoin has transitioned from an obscure digital collectible to an institutional asset class, particularly after March 2020. Since then, adoption rates have surged among both institutional and retail investors, with recent estimates indicating that Bitcoin’s user base has doubled in the past 18 months.

This shift can be largely attributed to institutional adoption, which has significantly enhanced Bitcoin’s mainstream acceptance and recognition. Insurance companies, sovereign wealth funds, pension funds, asset managers, hedge funds, family offices, and corporations have made substantial investments in Bitcoin over the past 18 months. This has been made possible with the approval of Bitcoin ETFs, opening up the doors to regulated institutions with a well-established, trusted financial product.

Thus, by 2025 Bitcoin has become substantially de-risked while still offering investors a compelling asymmetric investment opportunity.

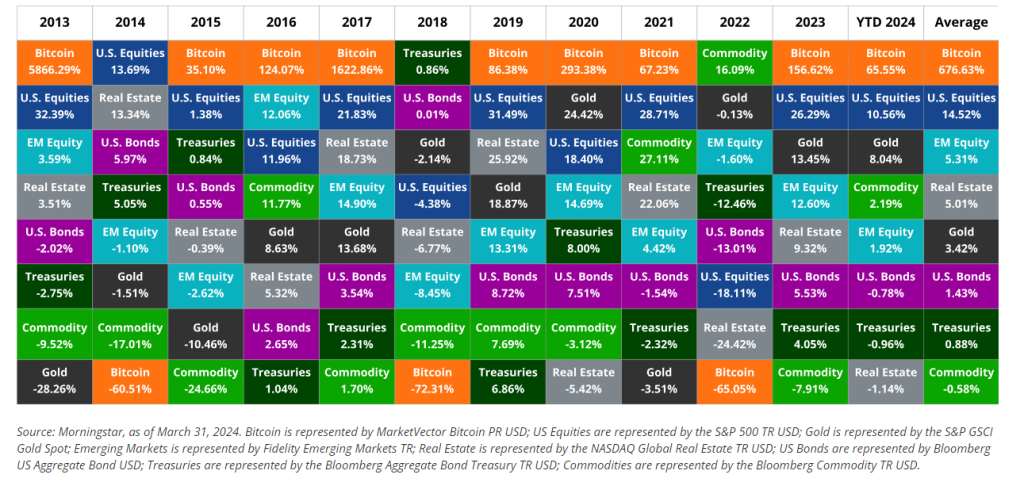

Bitcoin Has Outperformed All Other Asset Classes

The most exciting reason for many is Bitcoin’s unparalleled performance compared to other major asset classes over any significant period. There are no free lunches in investing, and in exchange for extraordinary returns, investors must be prepared to endure short-term volatility.

If Bitcoin’s volatility is a concern, simply reducing your position can help manage the associated risks.

Interested in Bitcoin Self-Custody? Book a FREE discovery session today!